We Know the Place℠

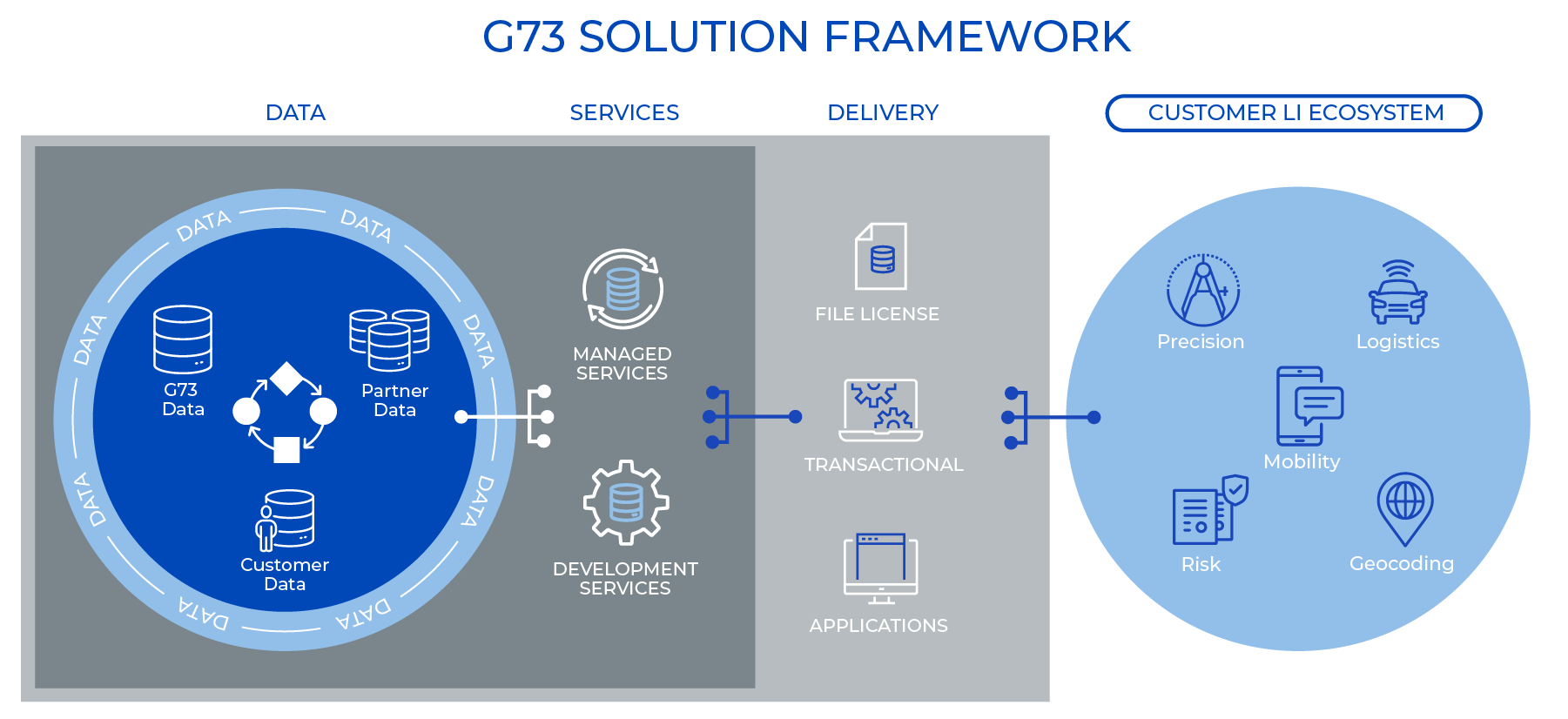

G73 Data Solutions. A leader in location intelligence for business success.

There are places on a map, and places your prospects are considering on their home-buying journey. When you combine those two, that's true genius. G73 Data Solutions brings together surrounding activity on millions of homes, in real-time, to deliver previously unseen customer insights.

Marketers in financial services, telecommunication, home services and more identify new strategies built on knowing where home buyers and sellers are in their process and what products and services they require. Discover highly qualified customers, improve the performance of your campaigns, and unleash new opportunity.

Location Intelligence is the difference maker.

Location data adds a new level of potential to your data-driven strategies. But addresses change constantly and even a minor change or variance - 123 N. Main St. vs. 123 North Main Street - can infect all your applications. Bad data makes for bad decisions and impacts planning, marketing, and wherever you apply location data in your business. G73 is the trusted resource for those who need data to understand the characteristics and behaviors surrounding millions of properties with a high level of accuracy and in real-time.

Meeting Your business Challenges with Location Intelligence

Enhance your Address Certainty

Improve the quality of your address data across your organization and establish a standard for how accurate and precise address data flows into your applications.

Generate More Leads

Match the right offer to the right customer at the right time. G73's location data, delivered through your applications, can help you determine the “next best offer” to make to your customer and prospect base.

Power Your Applications

G73 makes completed, cleansed, standardized, normalized, and geocoded data readily available to your applications for marketing, operations, customer service, and network planning.

G73 Core Solutions - Great Accuracy and Better Decisions.

Serving Great Clients for Over 20 Years

|  | |

|  |  |